Picking a reduced deductible ways you pay much less cash when something takes place to your vehicle, however your regular monthly repayments will normally be higher. While you'll always intend to consider your personal situation and choices, individuals who choose greater deductibles often value a reduced regular monthly costs may prefer to deal with small claims on their own or might have a lower-valued vehicle that they prefer to change in case of an accident - accident.

To select the appropriate insurance deductible for you, right here are a couple of points that will be practical to take into consideration: If you were to choose a $1,000 deductible, would certainly it be challenging to find up with the funds in case of an accident? Everybody is different. Some people prefer to handle small fixings by themselves as well as only look to their insurance policy in much more expensive scenarios, while others are extra likely to submit an insurance claim despite the dimension (vehicle insurance).

cheaper car low cost auto automobile car

cheaper car low cost auto automobile car

Or, they may decline these protections completely if it doesn't make economic feeling when thinking about the value of their automobile (cheaper car). When submitting a car insurance claim, there will be specific scenarios that will certainly need you to pay an insurance deductible and also others that will not. Allow's consider a couple of circumstances (a non-exhaustive listing, of training course) where you 'd likely require to pay a deductible: When filing an accident case after a single-car crash; When filing a collision case after you are at mistake in a multi-car accident; When submitting an extensive case after an event other than accidents, such as theft, fire, or hail; When you're encountered with an unforeseen and also undesirable occasion, not having to pay an insurance deductible can really feel like a huge relief.

If you chose a $0 deductible auto insurance alternative, no insurance deductible would be needed when sending an insurance claim under that insurance coverage type - cheap auto insurance. So since you've obtained the rundown on cars and truck insurance policy deductibles, how to choose them, and also what options you have, how do you feel about your own? At Clearcover, we're all concerning making insurance coverage quick, easy, and also simple.

Take control of your coverage as well as see what you can save by switching to Clearcover (any kind of time, all online). vans.

For the responsibility section of your auto insurance coverage plan, which covers the prices to fix any damage to another motorist's lorry, there is no insurance deductible on your automobile insurance policy when you're at fault in a mishap. Almost all states need chauffeurs to lug obligation insurance coverage. There are separate auto insurance deductibles on collision as well as thorough insurance coverage.

Car Insurance Deductibles - How Do They Work? - 21st.com Fundamentals Explained

Other states with substantial cost savings were (14 percent), (13 percent), (13 percent) as well as (12 percent). Consumers in Michigan as well as Florida saw the smallest savings at 4 percent. The nationwide ordinary conserving on costs was 15 percent. But the survey found that consumers in South Dakota can save a massive 28 percent, while customers in North Carolina saw the smallest savings, only about 6 percent.

Consider each deductible independently, and also take into consideration setting various deductibles for your vehicle insurance policy comprehensive insurance deductible and also your collision insurance deductible. insurance companies. For instance, you might check out minimizing your comprehensive insurance deductible given that it represents a smaller sized portion of the total costs. That suggests you won't conserve much money if you increase this insurance deductible.

Despite the fact that your insurance deductible does not reset each year, you would still require to pay a deductible each time you make an insurance claim. Some insurance companies will certainly decrease your deductible for each year you do not have an accident. What you may not see is that these "cost savings" are inflating the price of your premium (suvs).

If it only takes a few months or a year, you can set apart sufficient to pay your premium, and after that start banking the remainder. Paying an insurance deductible can indicate needing to cough up a hefty chunk of change. If you're worried that you can't afford to find up with enough money to pay your deductible, you have a few alternatives.

When you're trying to identify just how much your deductible need to be for vehicle insurance policy, ask your insurance company concerning what their procedure is for gathering deductibles, and for how long it might consider you to receive a payout. Here's what you can typically expect in a few various situations. First, your insurance provider needs to approve the claim in order for you to obtain a payment - insured car.

Once the quantity of your damages reaches your deductible, the insurance firm will certainly provide a payout for any kind of fixing prices over that quantity When you enter a crash with one more lorry, the insurer included will certainly carry out an examination right into which driver was at fault to determine who pays the auto insurance policy deductible - auto.

What Does Comprehensive Car Insurance: Do You Need It? - Nerdwallet Do?

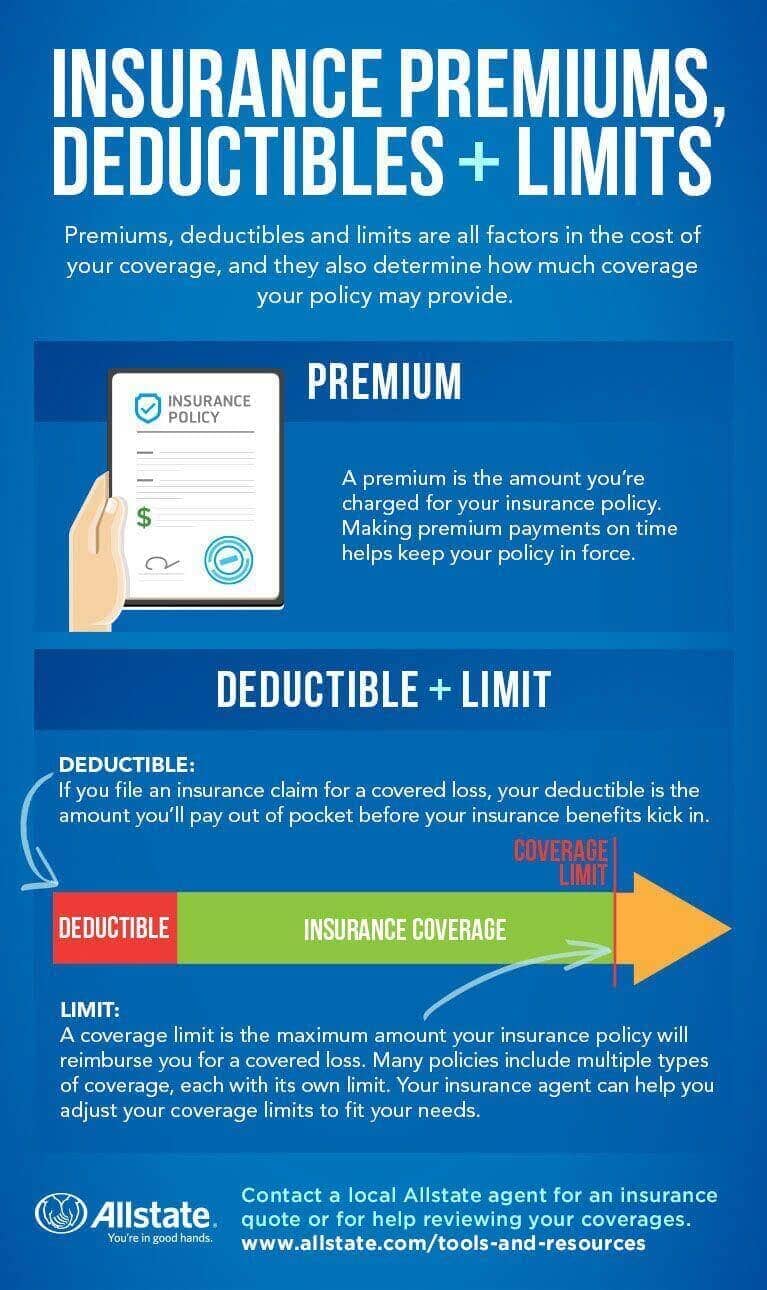

You may have wondered previously, how do insurance policy deductibles work? What are the different kinds of deductibles, and does the quantity influence the monthly settlements? In basic terms, an insurance deductible is the amount of cash you commit to pay out of pocket prior to your insurance firm begins to pay you any kind of benefits. insured car.

: Claim you have a deductible of $500 and also you rear end someone. If you are the at-fault chauffeur, the coverage will certainly need to originate from your collision policy. If your problems are $2000, you will need to pay the $500 insurance deductible and afterwards your insurance coverage will pay the remaining $1500.

You would certainly pay the complete $400 and also your insurance would not pay anything, since you did not get to the deductible. Various sorts of deductibles: An insurance deductible can be a set amount or a percent of the complete cost of your insurance claim. The instance over utilizes a fixed deductible. This number is something you will set with your insurance company before you authorize your policy.

So if you choose a higher insurance deductible your premium rate will certainly be lower. Simply bear in mind, if you select a high deductible, you need to have at least that much money conserved in instance you enter an accident as well as have to pay it. automobile. Where to discover your deductible: If you currently have an insurance coverage, you can discover the quantity of your deductible on the main web page of your policy, called the.

It is near the front of your plan. Examine to see what your deductible is, and if you have any trouble finding it or any type of various other inquiries in any way, call an Infinity agent at!.

A red cars and truck won't cost you more than a green, yellow, black, or blue car. Misconception # 2: My insurance policy will cover me if my vehicle is swiped, vandalized, or harmed by hail storm or fire.

The smart Trick of Comprehensive Car Insurance: Do You Need It? - Nerdwallet That Nobody is Discussing

Comprehensive insurance coverage pays for damages to your auto that is not the outcome of a cars and truck mishap. Myth # 3: If https://car-insurance-elgin-il.s3.sng01.cloud-object-storage.appdomain.cloud my vehicle is amounted to, my insurance policy will repay what I owe on my financing or lease. It will only pay you the actual cash money worth of your automobile, minus your deductible, factoring in depreciation.

Myth # 4: If a person else drives my cars and truck and also enters a crash, their auto insurance policy will certainly cover them, not mine. In many states, the vehicle proprietor's insurance policy have to pay for damages brought on by an accident. car insurance. Obtain acquainted with the laws in your state prior to permitting another individual to drive your vehicle.

Deductibles might be a typical part of insurance plan, but that doesn't indicate everybody recognizes exactly how they function. As a matter of fact, some drivers aren't conscious that your deductible can really impact the amount you pay for car insurance policy. Learn exactly how work, which protections they apply to, and exactly how you may be able to reduce your month-to-month auto insurance coverage payment by readjusting your insurance deductible.

Deductibles can put on the protections you have for damage to your automobile, like thorough and collision. You could likewise have an insurance deductible for medical repayments or individual injury protection. Put an additional means, "it's the amount of a repair expense you want to pay when you file an insurance claim," says - insurance companies.

Normally, the insured is responsible for covering the repair costs up to the insurance deductible; the insurance provider covers the remainder. What insurance deductible should I pick for automobile Insurance? The solution to this question will certainly differ from chauffeur to motorist. Depending upon your insurance coverage type, deductibles can vary anywhere from $100 to $1,500 (car).

cheaper insurance insure affordable

cheaper insurance insure affordable

What are you most comfy with? "Keep in mind that in case of loss you'll be accountable for the deductible, so make certain you're comfy with the quantity," claims the If you choose to elevate your deductible, do your finest to maintain the very least that quantity of cash in savings each month.

The Only Guide for Do I Pay My Deductible If I'm Not At Fault? - Hensley Legal ...

If you decide to reduce your deductible, you can always * to ensure that your protection feels much more budget friendly. In any case, pleasant agents at Straight Automobile Insurance policy can help you select the appropriate deductible for your scenario (automobile). Call or check out a for more information concerning car insurance policy deductibles today! * Not all pay strategies are offered in all states and undergo terms and conditions.

auto insurance cheaper cars auto insurance

auto insurance cheaper cars auto insurance

It is a particular dollar value that an insurance provider subtracts from your last claim negotiation when determining how much to pay you for a claim. To put it simply, an insurance deductible is a cost that you have to pay on your own before your insurance firm will certainly cover the continuing to be costs of an insurance claim.

In this circumstance, you need to spend for the very first $500 well worth of repairs before your policy will pay in any way (insurance). Any claims that are less than your deductible value will not have protection. When you begin looking for an insurance plan, your representative will likely ask you if you have a choice of what you want your deductible to be.

Various policy components could or could not have deductibles. Usually, you will certainly find them under your collision and also extensive vehicle insurance policy. These are the portions of your plan that will pay for your automobile damages. Collision coverage spends for damages suffered in a wreck while comprehensive protection spends for damage that is not associated with an accident, such as damages from vandalism, severe weather condition, dropping things or fires.

Other insurance coverage like your liability policy will certainly not pay you directly, however will compensate others for their losses that are your fault. Deductibles consequently normally do not apply to these kinds of cases. Normally, you will certainly have to pick the exact same deductibles for both your crash as well as thorough coverage. Various deductible regulations may use depending on the plan you pick.

If a mishap totals your car, after that your deductible will apply after the insurance firm computes the money value of your automobile. Suppose that your completed auto is worth $6,000 after numerous years of use. As a result of your $1,500 deductible, you will likely just receive a $4,500 settlement for your loss.

Some Of Deductible Fund: How It Works - Liberty Mutual

insurers credit score vehicle insurance insure

insurers credit score vehicle insurance insure

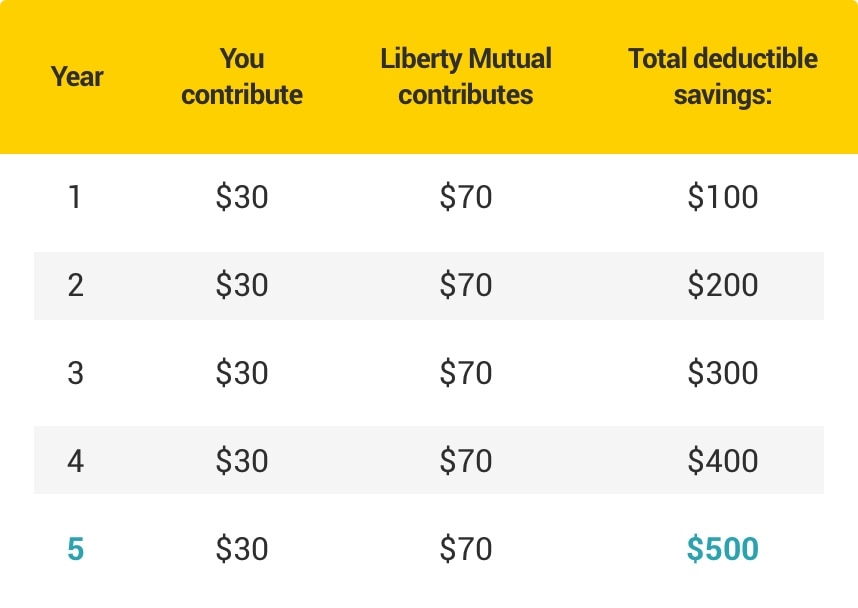

If you choose this option, your insurance company might consent to reduce your selected insurance deductible by a particular quantity for each year that you go without having a crash. If you go 3 years without a wreckage, after that you could conserve $300 on your deductible in year 3 without a considerable boost in your premium.

Vehicle insurance coverage deductibles might seem a little bit confusing, your independent auto insurance policy representative is a specialist that can assist you comprehend all situations when you might have to pay a deductible, and also exactly how that will certainly affect your ultimate claim negotiation. Whether you are seeking a new policy or simply wish to update your existing plan, we can aid you pick the deductible values that are best for you.

It is highly suggested that you do not let your representative decide the final price for you as they will certainly not have the most effective rate of interest in mind for you - credit. What as well as how does automobile insurance coverage deductibles work? When you shop around for cars and truck insurance coverage you would have come face to encounter with the term called auto insurance coverage deductible.